Decentralized Finance (DeFi) and Its Impact on Blockchain Technology

Transforming Finance

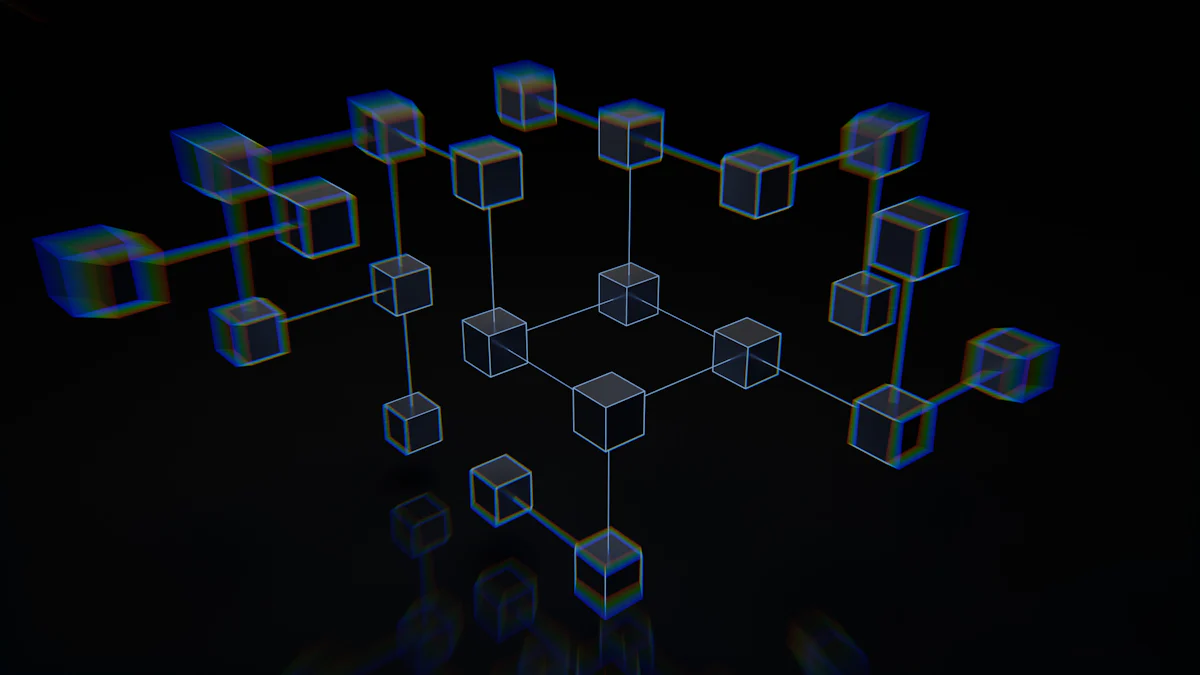

Decentralized Finance (DeFi) represents a fundamental shift in the traditional financial landscape. By embracing blockchain technology, DeFi introduces decentralized and distributed systems, such as peer-to-peer (P2P) networks, smart contracts, and decentralized storage. This transformation challenges the conventional centralized model of finance, offering greater accessibility and transparency to users. As a result, DeFi has the potential to revolutionize how financial services are accessed and utilized.

Blockchain technology: "The integration of blockchain technology has paved the way for decentralized finance, enabling innovative solutions that prioritize security and transparency."

Understanding DeFi

What is DeFi?

Decentralized Finance (DeFi) encompasses the utilization of blockchain technology and cryptocurrency to reconstruct traditional financial systems in a decentralized manner. Unlike conventional finance, DeFi operates without a central authority, aiming to enhance accessibility and transparency in financial services. By leveraging blockchain-based finance, DeFi offers an innovative approach to redefining how individuals access and interact with financial systems.

Key Components of DeFi

Integral to the functioning of DeFi are peer-to-peer (P2P) networks, smart contracts, and decentralized storage. These components form the backbone of decentralized applications (DApps) within the DeFi ecosystem, facilitating secure and efficient financial transactions outside the confines of traditional banking systems. Through these foundational elements, DeFi enables users to engage in a wide range of financial activities while bypassing centralized intermediaries.

Blockchain Integration

Utilizing Blockchain for DeFi

Blockchain technology serves as the underlying framework for DeFi, ensuring the security and immutability of financial transactions. By leveraging distributed ledger technology, DeFi platforms can execute transactions with transparency and trustlessness, eliminating the need for intermediaries. The integration of blockchain network and cryptocurrency technology enables seamless and secure financial operations within the decentralized finance ecosystem.

Smart Contracts and Decentralization

Smart contracts play a pivotal role in enhancing the efficiency of DeFi applications by enabling automated and self-executing agreements. These contracts are powered by blockchain technology, ensuring that financial data is distributed across the network in a decentralized manner. This decentralization reduces the risk of manipulation, fostering a more secure environment for financial transactions to take place.

Decentralized Finance (DeFi): "The integration of smart contracts and blockchain technology has revolutionized how financial agreements are executed, promoting transparency and efficiency within decentralized finance."

Disrupting Traditional Finance

Challenges to Traditional Finance

- The rise of decentralized finance (DeFi) presents a formidable challenge to traditional financial systems. By offering alternative, decentralized solutions, DeFi disrupts the conventional role of banks and financial intermediaries. This poses a significant threat to the established centralized model of finance, potentially reshaping the future landscape of financial services.

Impact on Global Financial Inclusion

- DeFi holds the potential to significantly expand global financial inclusion by catering to individuals who are underserved by traditional banking systems. Through its decentralized nature, DeFi empowers individuals to access essential financial services, such as lending and borrowing, without relying on a centralized authority. This has the profound effect of providing greater access and opportunities for those who have been excluded from traditional financial systems.

Future Prospects

Regulatory and Security Considerations

As the realm of Decentralized Finance (DeFi) continues to expand, the establishment of robust regulatory frameworks and security measures becomes increasingly imperative. These measures are essential to ensure the stability and legitimacy of DeFi as it integrates into the traditional financial landscape. The evolving nature of blockchain, distributed ledger technology, and cryptocurrency technology necessitates adaptable regulations that can effectively govern the decentralized financial ecosystem. Addressing these considerations will be pivotal in fostering a secure environment for widespread adoption while upholding the integrity of financial operations within the DeFi space.

Innovation and Evolution of DeFi

Looking ahead, the future of DeFi holds promise for further innovation and evolution. This includes the potential development of new financial products and services that leverage blockchain technology, distributed ledger systems, and enhanced interoperability with traditional finance. The continuous evolution of DeFi may lead to the creation of more efficient and accessible financial services, catering to a broader spectrum of users. As technological advancements unfold, DeFi is poised to revolutionize the accessibility and functionality of financial solutions on a global scale.

Decentralized Future

Decentralized Finance (DeFi) stands at the forefront of reshaping the future of financial systems. By embracing decentralization, transparency, and inclusivity, DeFi offers a paradigm shift in how financial services are accessed and utilized. Its integration with blockchain technology not only disrupts traditional finance but also lays the groundwork for innovative and secure financial solutions. Through the principles of decentralization and distributed networks, DeFi is poised to foster global financial inclusion, providing individuals worldwide with unprecedented access to essential financial services.