The Rise of DeFi: Revolutionizing Asset Issuance

The Rise of Decentralized Finance

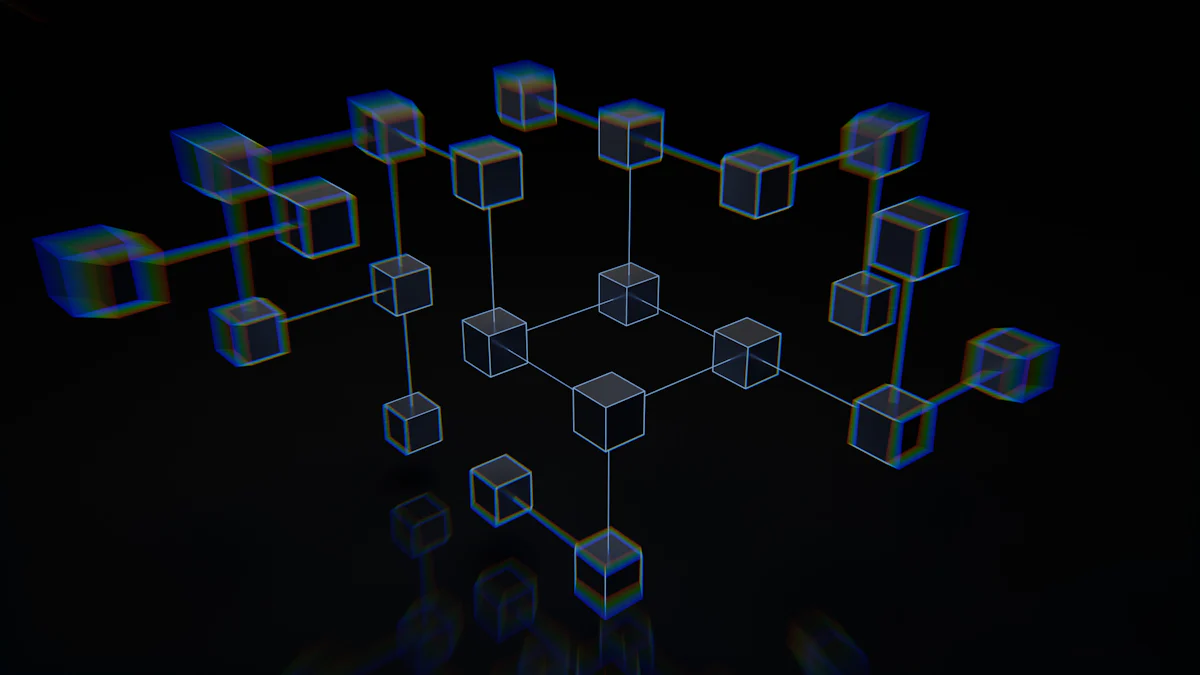

Decentralized Finance (DeFi) is revolutionizing the way assets are issued and managed in the financial industry. Unlike traditional finance, which relies on intermediaries such as banks and brokers, DeFi operates on a decentralized network powered by blockchain technology.

By leveraging smart contracts and decentralized applications (DApps), DeFi enables individuals to have direct control over their assets, eliminating the need for intermediaries. This decentralized approach brings numerous benefits, including increased transparency, lower costs, and enhanced security.

In recent years, the concept of DeFi has gained significant traction in the financial industry. More investors and financial technology professionals are recognizing its potential to disrupt traditional finance and unlock new opportunities for asset issuance and management. As DeFi continues to evolve, it holds the promise of democratizing access to financial services and transforming the way we interact with money.

Consensus-Based Asset Issuance

Consensus-based asset issuance plays a crucial role in the decentralized finance (DeFi) ecosystem by ensuring trust and transparency in the process. Unlike traditional asset issuance methods that rely on intermediaries and central authorities, DeFi leverages blockchain technology to enable a consensus-driven approach.

One of the key advantages of consensus-based asset issuance is the elimination of intermediaries and central authorities. In traditional finance, these entities often introduce inefficiencies, delays, and additional costs. By removing them from the equation, DeFi allows for a more streamlined and direct process.

Blockchain technology lies at the heart of consensus-based asset issuance in DeFi. It enables assets to be issued on a transparent and immutable ledger, ensuring that all transactions are recorded and auditable. This transparency builds trust among participants as they can verify the authenticity and ownership of assets without relying on third parties.

Furthermore, consensus-based asset issuance ensures that decisions regarding the creation and management of assets are made collectively by participants within the network. This democratic approach enhances decentralization and reduces the concentration of power in the hands of a few entities.

Overall, consensus-based asset issuance not only promotes trust and transparency but also empowers individuals to have greater control over their assets. By leveraging blockchain technology, DeFi is revolutionizing how assets are created, managed, and transferred in a secure and efficient manner.

Interoperability in DeFi

Interoperability plays a vital role in the decentralized finance (DeFi) ecosystem by enabling seamless communication and interaction between different decentralized applications (DApps). It allows for the transfer of assets and data across various DeFi platforms, enhancing the overall efficiency and usability of the ecosystem.

One of the key benefits of interoperability is that it breaks down barriers between different blockchain networks. In the world of DeFi, there are multiple blockchains, each with its own set of protocols and standards. Interoperability enables these blockchains to communicate with one another, facilitating cross-chain asset transfers and interactions.

By enabling assets to move freely between different DeFi platforms, interoperability enhances liquidity and expands investment opportunities. Users can leverage their assets across multiple platforms without being limited to a single network or protocol. This flexibility opens up new avenues for diversification and risk management.

Moreover, interoperability promotes collaboration among different projects within the DeFi ecosystem. Developers can build on existing protocols and leverage functionalities from other DApps, creating a more interconnected and innovative environment. This collaborative approach fosters rapid development and accelerates the growth of DeFi as a whole.

In summary, interoperability is a crucial component of DeFi that enables seamless communication and interaction between decentralized applications. It breaks down barriers, enhances liquidity, and promotes collaboration within the ecosystem. As DeFi continues to evolve, interoperability will play an increasingly important role in unlocking new possibilities for asset management and financial innovation.

The Implications of DeFi for Asset Issuance and Interoperability

DeFi has far-reaching implications for asset issuance and interoperability in the financial industry. It revolutionizes the traditional methods by providing a decentralized and transparent alternative. Consensus-based asset issuance ensures trust, eliminates the need for intermediaries, and empowers individuals to have direct control over their assets. On the other hand, interoperability enhances the functionality and usability of the DeFi ecosystem by enabling seamless communication and interaction between different decentralized applications. Together, these implications pave the way for a more inclusive, efficient, and innovative financial landscape where individuals can access a wide range of assets and participate in decentralized finance with ease.